how much tax do you pay for uber eats

It is important that you keep all. The amount youll pay depends on the amount and types of other income you have your filing status the tax deductions and.

How To Become An Uber Eats Driver Signup Process

How much money should I set aside for taxes for Uber Eats.

. Figure out how much to save. The exact percentage youll pay. Lets make it easy with an example the submission of the.

Unlike rides with Uber drivers who earn with Uber Eats are only obligated to register collect and remit sales tax from the moment they. In New Zealand you may need to register for GST if your turnover exceeds or is expected to exceed 60000 in a 12 month period. The Best Answer To The Question How much do restaurants pay for uber eats.

Use business income to figure out your self. You will receive one tax summary for all activity with Uber Eats and Uber. 950 per hour if you drive your own car.

110 of prior year taxes. If your accounts for Uber Eats and Uber use a different email address your earnings from deliveries and rides will. Uber drivers are required to submit their tax returns by 31st January if submitting online and by 31st October if submitting via post.

For more information on how much tax youll pay check out or blog post on How Much Youll Actually Make Driving For Uber. If you have questions on whether you need to register for GST due to how you partner with Uber we would recommend you contact the ATO or a taxation professional directly for advice. In relation to providing transportation services to riders.

Your federal and state income taxes. 9 per hour if youre paying for your car through car finance. Uzochukwu From your question I am assuming you are a new driver to Uber.

90 of current year taxes. Answer 1 of 6. Estimate your business income your taxable profits.

As you can see how much you can make with Uber Eats depends on a variety of factors with one of. How much money should I set aside for taxes for Uber Eats. AGI over 150000 75000 if married filing separate 100 of current year taxes.

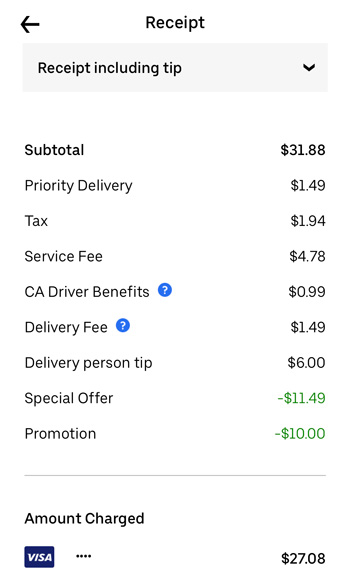

Recently Ubers UK head of public policy Andrew Byrne revealed three typical hourly rates. Customers pay a service fee of 15 of the subtotal a delivery fee based on location driver. I would keep all of your expenses and mileage in a spreadsheet.

How does UberEats work with taxes. All you need is the following information. Using our Uber driver tax calculator is easy.

Your federal tax rate can vary from 10 to 37 while your state rate can be anywhere from 0 to 1075. Regardless of how much you make according to the ATO any income you earn as a food delivery driver must be declared on your tax return. What the tax impact calculator is going to do is follow these six steps.

You should file a Form 1040 and attach Schedule C and. The current surcharge is scheduled to remain in place for the next 60 days. The amount youll pay depends on the amount and types of other income you have your filing status the tax deductions and.

Uzair July 24. Delivery driver tax obligations. Once you know your taxable profit for the week or month or quarter depending on how you decide to do things you can start figuring.

100 of prior year taxes. Your average number of rides. For the majority of you the answer is yes If your net earnings from Uber exceed 400 you must report that income.

My question is do i need. The average number of hours you drive per week.

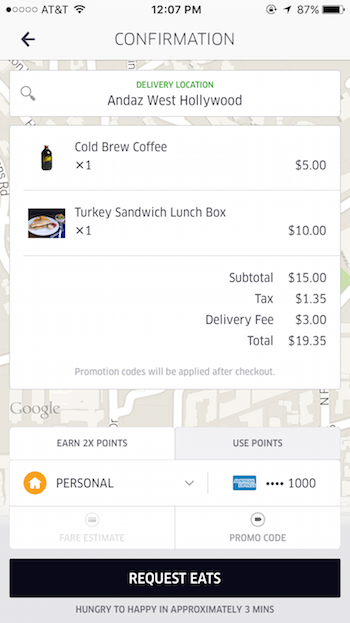

How Much Does Uber Eats Cost And Learn How To Save On Orders Ridesharing Driver

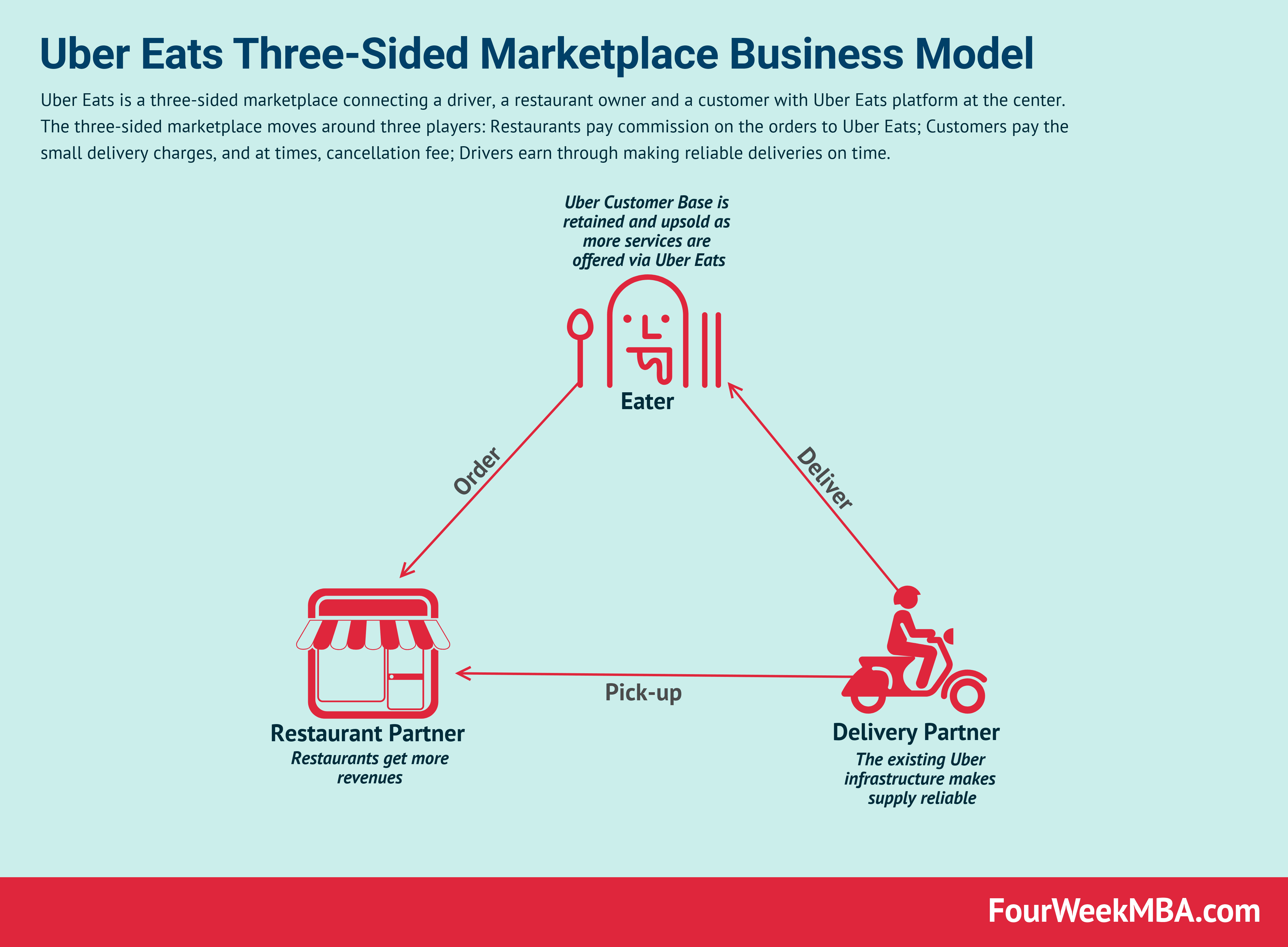

The Uber Eats Business Model 2022 Update Fourweekmba

My First Experience With Ubereats One Mile At A Time

Rakuten Pay Online Payment Rolls Out On Uber Eats Rakuten Group Inc

Ultimate Tax Guide For Uber Lyft Drivers Updated For 2022

If I Did Uber Eats Do I Only Do A 1099 Or A Schedule C Too Quora

Uber Eats Taxes How To File Taxes For Uber Eats And Tax Forms Tfx

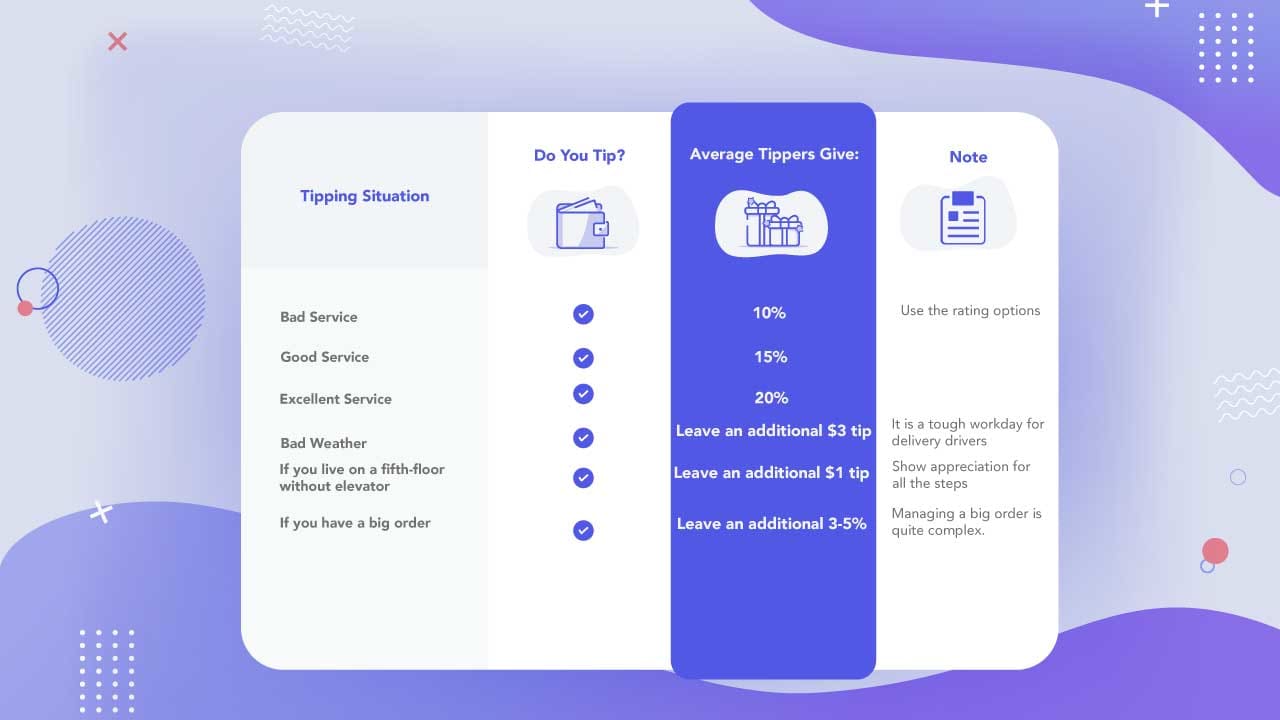

Do Uber Eats Drivers See Your Tip When You Order Food Online

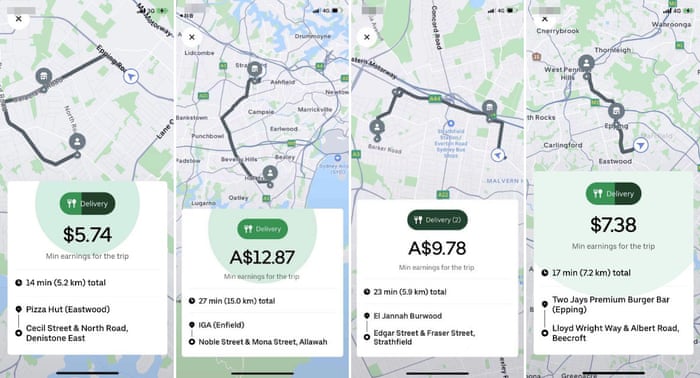

Uber Eats Riders Earning As Little As 5 For Deliveries Crossing Multiple Nsw Suburbs Uber The Guardian

How Does Uber Eats Work About Uber Eats

/cdn.vox-cdn.com/uploads/chorus_asset/file/15972748/Screen_Shot_2019_03_19_at_1.52.15_PM.png)

Uber Eats Rolls Out Confusing New Fees Here S What They Mean The Verge

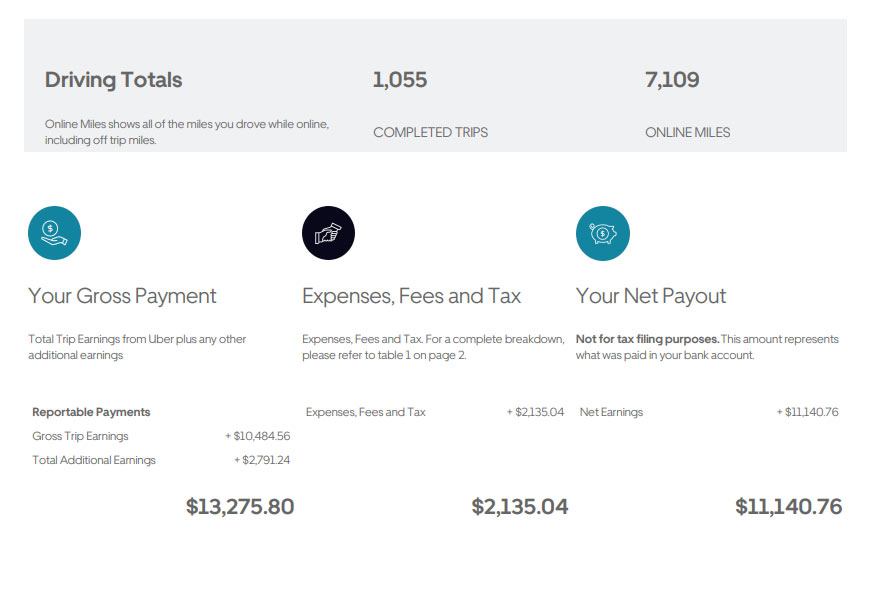

How Uber S Tax Calculation May Have Cost Drivers Hundreds Of Millions The New York Times

How Much Does Uber Eats Pay Per Delivery In 2022 Ultimate Guide

Uber Eats Overcharges New York Customers On Sales Tax New Class Action Alleges Top Class Actions

Uber Taxes Explained How To File Taxes For Uber Lyft Drivers Youtube

Why Does My Uber Eats 1099 Or Annual Tax Summary Say I Made More Than I Did Entrecourier

Now Delivering Eats And Don T Eats Uber Newsroom

Top 7 Mistakes That Rideshare Drivers Make At Tax Time Stride Blog